1

Feature Story

Baillie Cools on Tech in Favor of 'Boring' Infrastructure Stocks

Dec 10, 2024 · financialpost.com

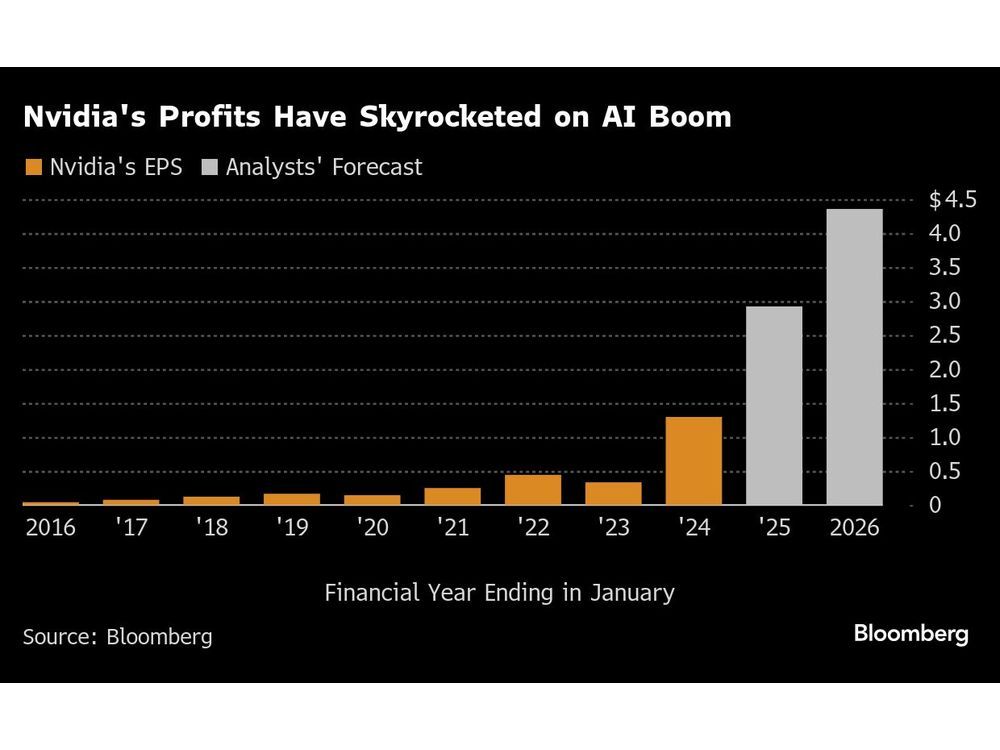

Dunbar emphasized that the firm's strategy is not a departure from its growth stock focus, as it continues to seek companies capable of rapid and profitable growth. Baillie Gifford is also optimistic about the resurgence of Chinese tech shares, despite geopolitical challenges. The firm remains invested in Nvidia, albeit cautiously, due to its high valuation, and continues to support Amazon and Meta for their strong R&D and data capabilities. Tesla is favored for its robotics and energy ventures, despite competition from BYD, which offers more affordable cars.

Key takeaways

- Baillie Gifford & Co., traditionally known for investing in high-growth tech stocks, is now focusing on US infrastructure companies due to anticipated building booms after years of under-investment.

- The firm remains cautious about many US tech stocks due to high valuations, although it still holds some, like Nvidia, while being wary of potential threats to companies like Google from AI advancements.

- Baillie Gifford sees growth opportunities in infrastructure sectors, citing companies like Advanced Drainage Systems Inc. and Stella-Jones Inc. as favorites.

- The investment manager is also optimistic about digital banking trends, investing in fintech firms such as Nu Holdings Ltd. in Brazil and Adyen NV in the Netherlands.