1

Feature Story

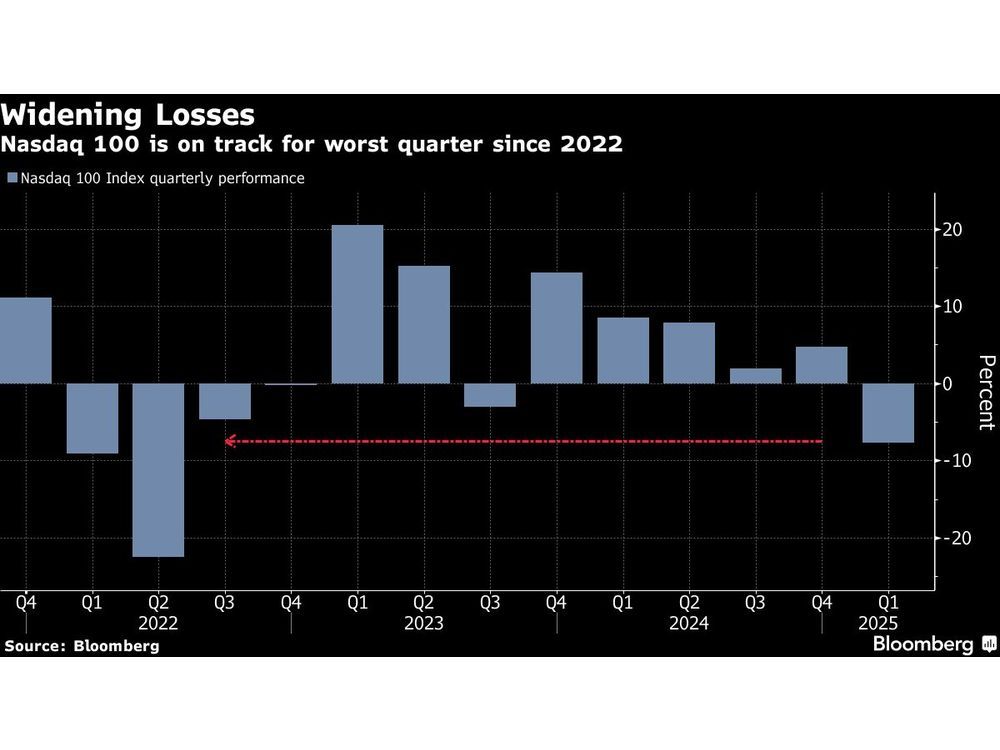

Market Rout Intensifies as Tariff, Inflation Fears Rock Big Tech

Mar 28, 2025 · financialpost.com

The economic outlook appears grim as the Federal Reserve's preferred inflation measure remains high, and consumer spending data falls short of expectations. This has led to a rotation out of tech stocks, which had previously driven market gains due to optimism about artificial intelligence. However, with AI profits yet to materialize and fears of overbuilding in tech infrastructure, investors are pulling back. The decline in tech stocks has also impacted energy companies like Vistra Corp., which have benefited from data center spending. Overall, the market is grappling with uncertainties surrounding tariffs, inflation, and the sustainability of tech-driven growth.

Key takeaways

- US stocks fell sharply due to renewed tariff concerns and persistent inflation, with significant losses in the tech sector.

- Investors are selling tech stocks, including Nvidia and Palantir, amid fears of a bubble and economic uncertainty.

- Concerns about overbuilding in AI infrastructure and its slow adoption are impacting tech and energy companies.

- The Federal Reserve's preferred inflation measure remains high, and consumer spending is lower than expected, raising economic concerns.