1

Feature Story

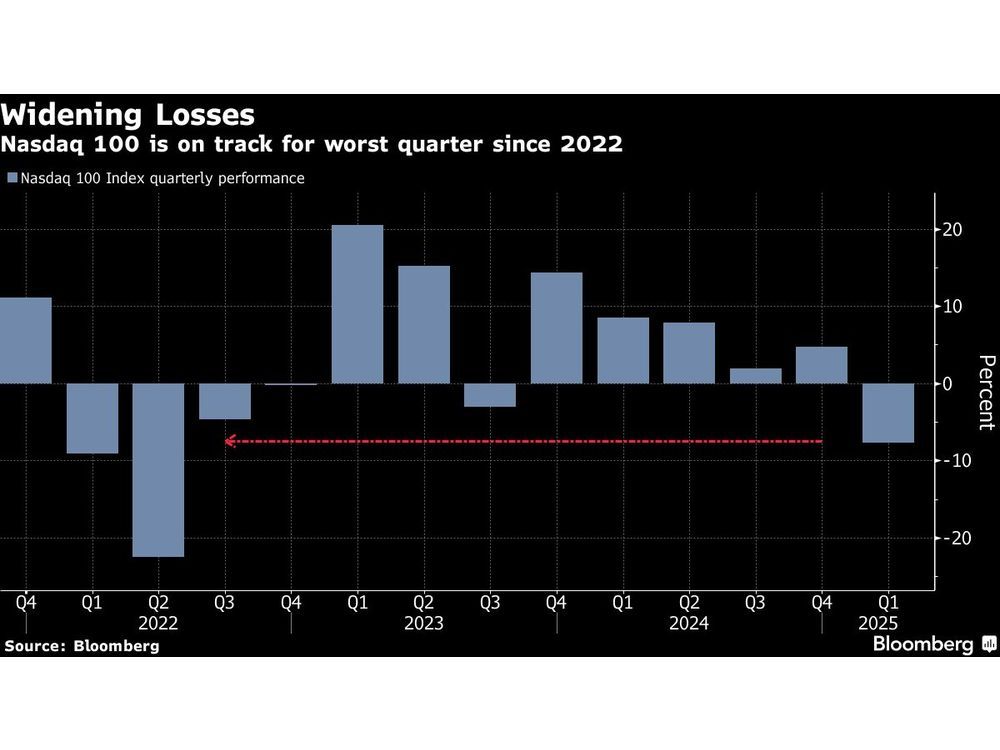

Market Rout Starts With Big Tech as Tariff, Inflation Fears Hit

Mar 28, 2025 · financialpost.com

Additionally, energy companies like Vistra Corp. and GE Vernova Inc. also faced declines, as the demand for AI-related infrastructure may not meet expectations, potentially slowing investments in the sector. The Federal Reserve's inflation measure remains high, and consumer spending is lower than anticipated, further exacerbating economic concerns. President Donald Trump's ongoing tariff disputes add to the market's instability, with fears that tech giants may be overbuilding in anticipation of AI service demand that has yet to materialize.

Key takeaways

- US stocks experienced a significant decline due to renewed tariff concerns, persistent inflation, and weakened consumer spending.

- The tech sector, which had previously driven market rallies, is now facing challenges as AI-related stocks suffer losses.

- Economic concerns are heightened by the Federal Reserve's inflation measures and lower-than-expected consumer spending data.

- There are fears of overbuilding in AI infrastructure, which could impact companies like Nvidia and Vistra if consumer demand does not meet expectations.