1

Feature Story

Nasdaq 100 Sinks Into Bear Market as Trump Tariffs Spark Rout

Apr 04, 2025 · financialpost.com

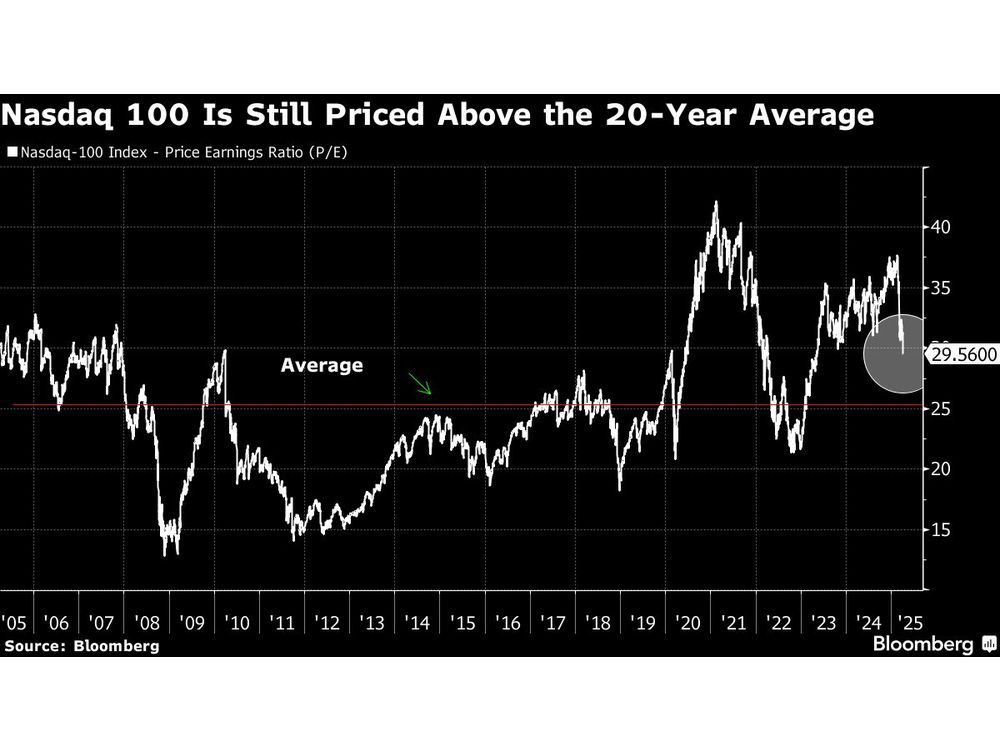

The selloff marks the biggest slump for the Nasdaq 100 since 2022, a year marked by economic slowdown and shrinking profits. The release of OpenAI’s ChatGPT in late 2022 had previously lifted the index, driven by optimism around AI technology. However, recent losses have stripped Big Tech of its defensive stock status, as investors seek safer investments like Treasuries. The high costs associated with AI investments and slowing earnings growth have led to skepticism about when these expenditures will yield returns. The Nasdaq 100’s price-to-earnings ratio has decreased from 38 to 28, but remains above the two-decade average of 25, prompting caution among investors.

Key takeaways

- The Nasdaq 100 has entered a bear market, with losses exceeding 20% from a February high, driven by investor concerns over President Donald Trump's tariffs and a potential recession.

- The selloff has erased approximately $6.4 trillion from the tech-heavy benchmark, significantly impacting major companies like Apple Inc. and Nvidia Corp.

- Despite the market downturn, the Nasdaq 100's price-to-earnings ratio remains above the historical average, raising concerns about further declines if a recession occurs.

- Investors are questioning the profitability of Big Tech's substantial investments in AI, as growth in earnings is expected to slow and the cost of AI infrastructure remains high.