1

Feature Story

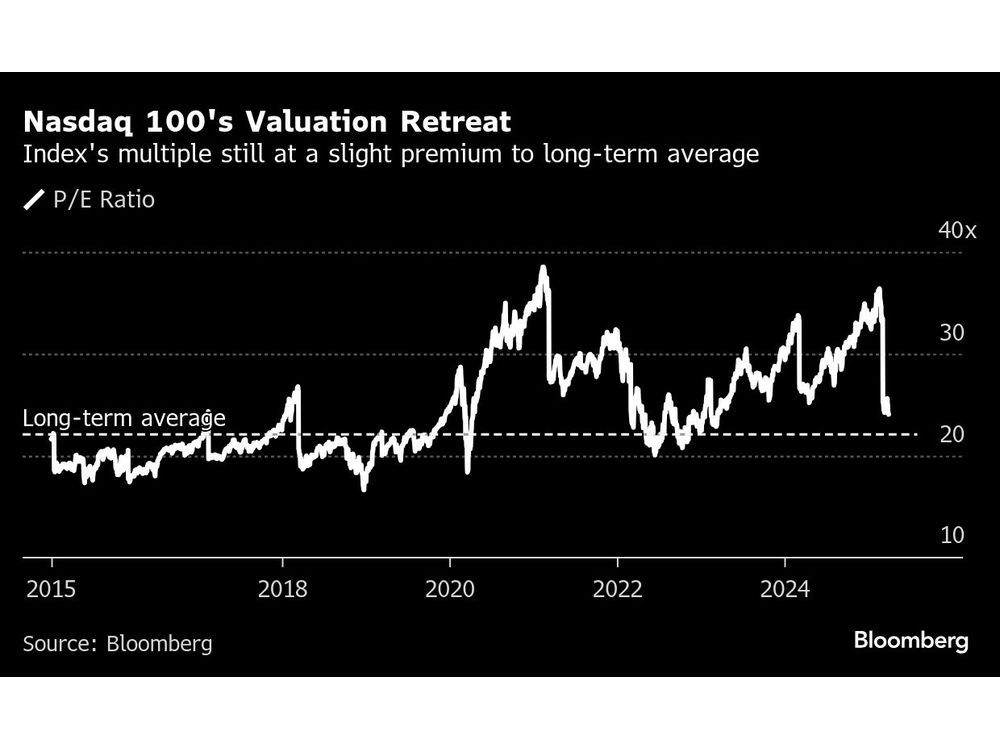

Nasdaq 100's Worst Quarter in Years Sealed by AI Bubble Fears

Mar 31, 2025 · financialpost.com

Despite the downturn, major tech firms remain committed to substantial capital expenditures, with Microsoft, Alphabet, Amazon, and Meta planning to spend over $300 billion collectively in their current fiscal years. However, doubts persist about the immediate return on investment and the broader adoption of AI tools in corporate America. This uncertainty has affected investor sentiment, as seen in the underwhelming IPO of Nvidia-backed CoreWeave Inc., which fell short of expectations. While some analysts see potential for a rebound, the prevailing mood on Wall Street is cautious, reflecting concerns over a slowdown in AI spending.

Key takeaways

- The Nasdaq 100 experienced its worst quarter in nearly three years, dropping 8.3% due to fears of an AI bubble and other economic uncertainties.

- Major tech stocks like Nvidia, Broadcom, Microsoft, Amazon, and Alphabet have seen significant declines from their peak values.

- Concerns about oversupply in AI infrastructure investments have been fueled by reports of companies like Microsoft pulling back on new projects.

- Despite the downturn, some investors remain optimistic about AI-related stocks, expecting continued demand for AI services and infrastructure.