1

Feature Story

Super Micro Faces Delisting, S&P 500 Removal Amid Auditor Woes

Nov 05, 2024 · financialpost.com

If delisted, it would be the second time for Super Micro, which was previously delisted in 2019 for failing to meet filing deadlines. The company's listing status is already uncertain after it failed to file its annual 10-K report by the August deadline. Nasdaq rules give the company until mid-November to submit a plan to restore compliance. If approved, the deadline could be extended to February 2025. However, the resignation of Ernst & Young makes this more challenging.

Key takeaways

- Super Micro Computer Inc. is facing potential delisting from Nasdaq and removal from the S&P 500 due to compliance issues and the resignation of its auditor, Ernst & Young LLP.

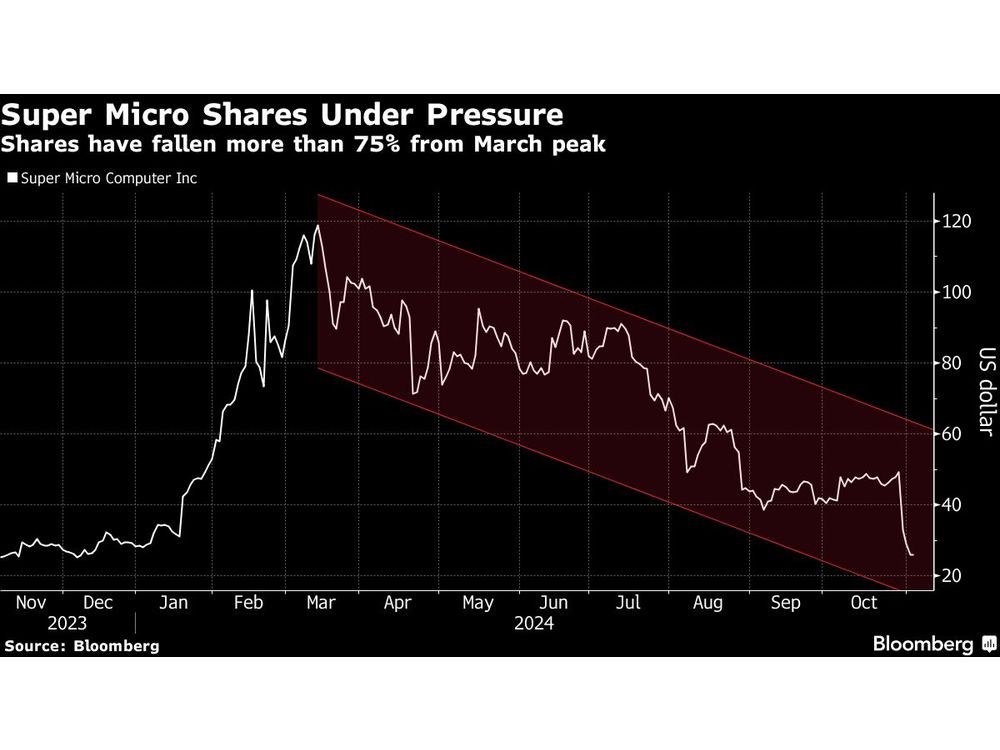

- The company's shares have plummeted more than 75% since March, and it failed to file its annual 10-K report by the August deadline.

- Ernst & Young's resignation was due to concerns about Super Micro's commitment to integrity and ethics, following a US Department of Justice probe and a damaging short-seller report.

- A Nasdaq delisting could lead to forced selling of the shares by institutions and could also trigger removal from the S&P 500.