1

Feature Story

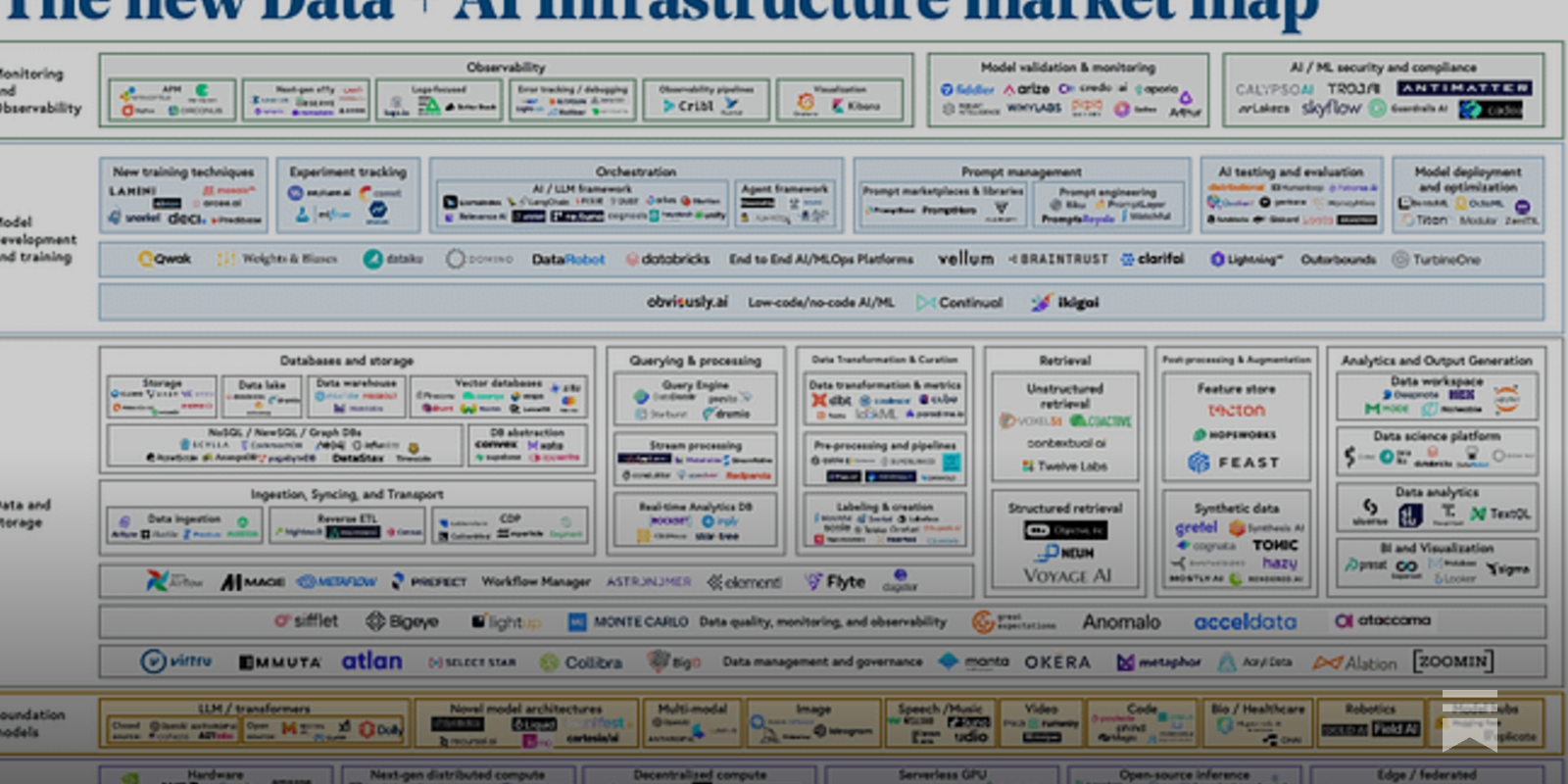

Why AI Infrastructure Startups Are Insanely Hard to Build

Jul 03, 2024 · nextword.substack.com

The author suggests that AI infrastructure startups can succeed by narrowing their scope, focusing on one workload, raising more venture capital than they think they need, or not raising any venture capital at all. The author also advises startups to be open to being acquired by a larger player and warns that the M&A landscape for the AI infrastructure sector will likely worsen over time.

Key takeaways

- The author argues that AI infrastructure startups are a "tarpit idea", meaning they sound reasonable but fail to hold up against reality, due to lack of differentiation and capital to crack the enterprise segment.

- The competitive dynamics in the AI infrastructure space, with many entities offering similar features and incumbents having more usage data and relationships, make it difficult for startups to maintain a sustainable lead.

- Three other major forces worsening the competitive environment are the demand for composability, the plummeting of inference costs, and the strategy of incumbents to create an "end-to-end AI platform".

- The author suggests that AI startups should think deeply about how to be different from the incumbents, narrow down their scope, focus on one workload, raise more VC money than they think they need, or avoid raising VC money at all.